At an average of $8,300 per family, New Mexico leads the nation in credit card debt, according to media reports at the end of 2018. New Mexico also has one of the highest poverty rates in the US, with one in five people living below the poverty line.

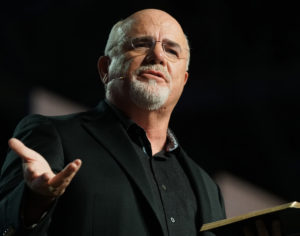

Those realities are among factors that provoked Joseph Bunce, executive director of the Baptist Convention of New Mexico, to forge a partnership with Ramsey Solutions, an organization led by personal finance author and speaker Dave Ramsey. The BCNM is among sixteen Baptist state conventions to launch such partnerships with Ramsey Solutions this year in an effort to help believers learn to manage their money. Additional state convention partnerships are in the works, according to Ramsey Solutions.

From Arizona to Pennsylvania-South Jersey, state convention meetings last fall highlighted the partnerships.

“We really want to equip churches to have something in their toolbox to assist people” with finances, Bunce told Baptist Press in a December interview.

The state convention partnerships dovetail with an effort launched by the SBC Executive Committee at its 2018 annual meeting in Dallas. Under an SBC-Ramsey Solutions partnership, pastors at the annual meeting received free twelve-month access to Financial Peace University (FPU), Dave Ramsey’s signature personal finance course. Additionally, Ramsey Solutions discounted FPU leader kits to $99 for Southern Baptist churches from their usual cost of $159.

The SBC Executive Committee offered a further $20 discount on FPU leader kits for the first five hundred pastors to sign up.

State conventions were invited by the Executive Committee late last summer to consider similar partnerships with Ramsey Solutions. The state partnerships feature free FPU access for pastors and the $99 rate for leader kits. Of the sixteen state convention partnerships to date, fourteen include a further $20 discount funded by the state convention. The number of churches eligible for the additional discount varies from twenty-five to five hundred, depending on the respective state convention’s needs and budget.

In Arizona and New Mexico, the state conventions also will offer Momentum Training events in 2019, where speakers from Ramsey Solutions will help leaders understand how to equip their entire congregations—from children to senior adults—to handle money well.

Dave Ramsey told Southern Baptists during last year’s SBC annual meeting in Dallas of the urgent need to teach Christians nationwide about biblical money management. He told messengers that 70 percent of Americans are living paycheck to paycheck, while 16 percent are coming into bankruptcy, going out of bankruptcy, or are currently in bankruptcy, and 2 percent are in dire poverty.

Brent Spicer, Ramsey Solutions’ director of strategic relationships, said one goal of the state convention partnerships is “to help churches who either had never done an FPU class, or maybe haven’t done one in several years, and might not have the leadership materials to help get them started.”

The “ultimate goal of offering those classes is to help the families in the churches become more financially healthy,” Spicer said, “which would allow the families then to be able to be more generous to the churches in their local community. The churches then are able to support the Cooperative Program in a bigger way.”

Tennessee Baptists have set a goal of five hundred churches offering FPU classes in the next thirty-six months, said Randy Davis, president of the Tennessee Baptist Mission Board. Over the past eighteen months, 137 Tennessee Baptist churches have offered FPU.

Financial stewardship is “one of the biggest issues we face,” Davis said. “We see so many of our families in financial bondage. They do not believe they can give generously. They do not believe they can tithe.

“When they implement the principles of Ramsey Solutions, it will help them not only get out of debt, but manage what God has placed in their hands in a more effective manner—for the sake of the Kingdom and the sake of their own families,” Davis said.

If Tennessee Baptists as a whole got their personal finances in order and began tithing, Davis said, the increased revenue to churches could in turn increase CP giving 30–40 percent in the “near future.”

Davis and Bunce agreed, however, that while a CP increase would be nice, it isn’t the primary goal of their partnerships with Ramsey Solutions.

“The primary motive,” Bunce said, “is to help people be obedient to God.”

State conventions interested in partnerships with Ramsey Solutions can contact Spicer at [email protected].